Market Update

The number one topic driving the market is when the Fed will begin cutting interest rates. Fed leaders have communicated that cutting rates will be dependent on inflation continuing its down trend and weakening economic data. Successfully anticipating Fed decisions on this matter will be about tracking relevant economic data points and the evolving geopolitical landscape.

We kicked off 2024 with a surprisingly strong week of employment data, Fed minutes, and global shipping disruptions due to escalating tensions in the Middle East. The developments in these areas can lead to high inflation and ultimately higher for longer interest rates or even rate raises. As stated in our 2024 Investment Outlook, there are several risks to inflation still present.

Labor Data

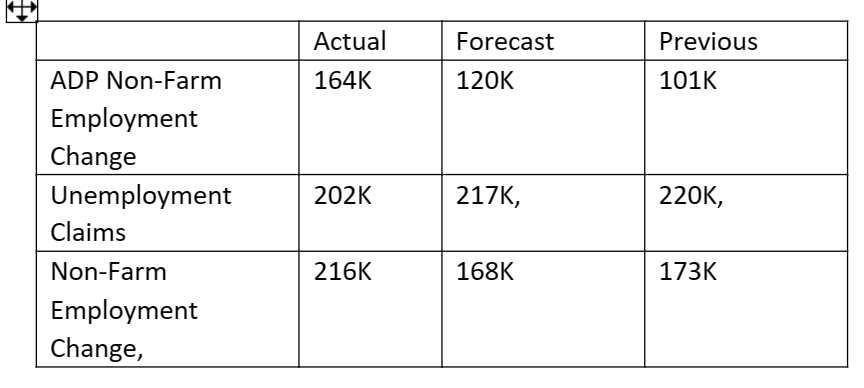

Last week a number of jobs reports came out. We highlighted them in yellow in the screen shot above. Both ADP Non-Farm Employment Change and the Bureau of Labor Statistics reported higher than expected growth in jobs and both had a significant increase compared to the previous reports which reflects a stronger than expected job market. Unemployment claims also came in weaker than expected and lower than last week's report, which also reflects a stronger than expected job market. Below is a table with the most recent results.

A job market that continues to grow can lead to higher inflation. It’s important to pay close attention to employment data and inflation over the next few months. Rising employment can lead to higher inflation which could force the Fed to keep interest rates higher for longer or even to raise rates. The Fed taking either of these actions could lead to a selloff in US stocks.

Red Sea Crisis

As the war continues in the Middle East, the Red Sea has now become the focus. There have been attacks and seizures on shipping vessels passing through the Red Sea. This led several major shipping companies to suspend operations in the Red Sea.

Why is this important

The Red Sea accounts for 12% of global trade and 30% of global container traffic. Further issues in this area can lead to delays with shipment and higher prices for items. The current situation has already led to higher shipping costs which will ultimately be passed on to consumers. If this trend continues, we can expect global inflation to move higher.

Where are we in the market?

Going into the final weeks of 2023 we saw a strong rally in the US stock market on the anticipation that the Federal Reserve will begin cutting interest rates. With weakening economic data reported during that period and the Fed hinting towards rate cuts in 2024 if inflation continues to subside. Investors were feeling confident that rate cuts should be coming, and inflation will continue to go down, hence the strong rally.

This week, inflation data will be reported and retail sales in the following week. If inflation and retails sales come in stronger than expected, you can expect the media to promote higher for longer interest rates. On the flip side, if those data points come in weaker than expected, expect the market to rally on hopes that we will be moving closer to cutting interest rates.

Upcoming Economic Data

Here are some important dates for economic reports we will be paying very close attention to through the end of January.

Jan. 11, 2023 @ 8:30AM EST- CPI (Inflation report)

Jan. 12, 2023 @ 8:30AM EST- PPI (Inflation Report)

Jan. 17, 2023 @ 8:30AM EST-Retail Sales

Jan. 25, 2023 @ 8:30AM EST- Advance GDP

Jan. 26, 2023 @ 8:30AM EST- PCE (Consumer Spending Report)

Jan. 31, 2023 @ 2:00PM EST- Fed Funds Rate (Interest Rate Decision)

Feel free to comment any thoughts or questions you may have!