2024 Investment Outlook

The Fed’s recent rate announcement has signaled an end to the latest rate raising cycle and the beginning of a rate lowering cycle. The Fed has forecasted potential rate cuts in 2024. The market has eagerly been awaiting this news and has sent markets soaring. As we look ahead into 2024 here is what I will be focusing on

Risks:

The Fed potentially lowering rates is a great thing, but we are not out of the woods yet. The Fed is looking to begin lowering rates and will assess how the economy reacts. One of the biggest challenges with inflation was not just supply chain issues and high commodity prices, a relentless US consumer helped maintain high inflation numbers. US consumers did not stop purchasing regardless of the increase in prices. As the economy moves forward, I will be paying close attention to the following:

Consumer data

Inflation

Commodities

Supply chains

Real Estate Data

Inflation:

If inflation picks back up while the Fed starts lowering rates, the Fed can potentially halt rate cuts or even raise rates again. I am not predicting this scenario; I am saying to be prepared mentally to reposition yourself if the situation arises. You do not want to get caught off guard and take an unnecessary hit in your portfolio.

Consumer Data

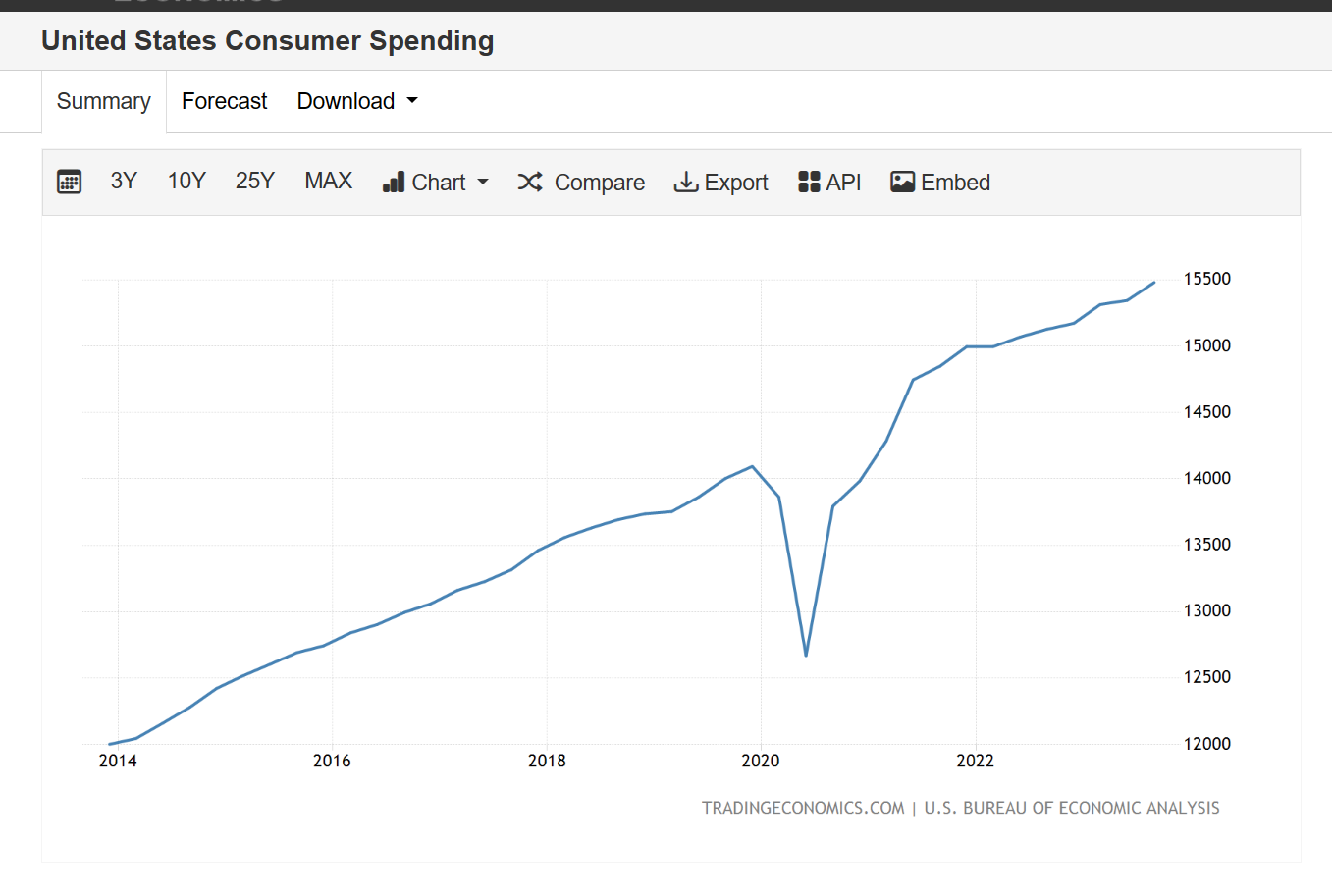

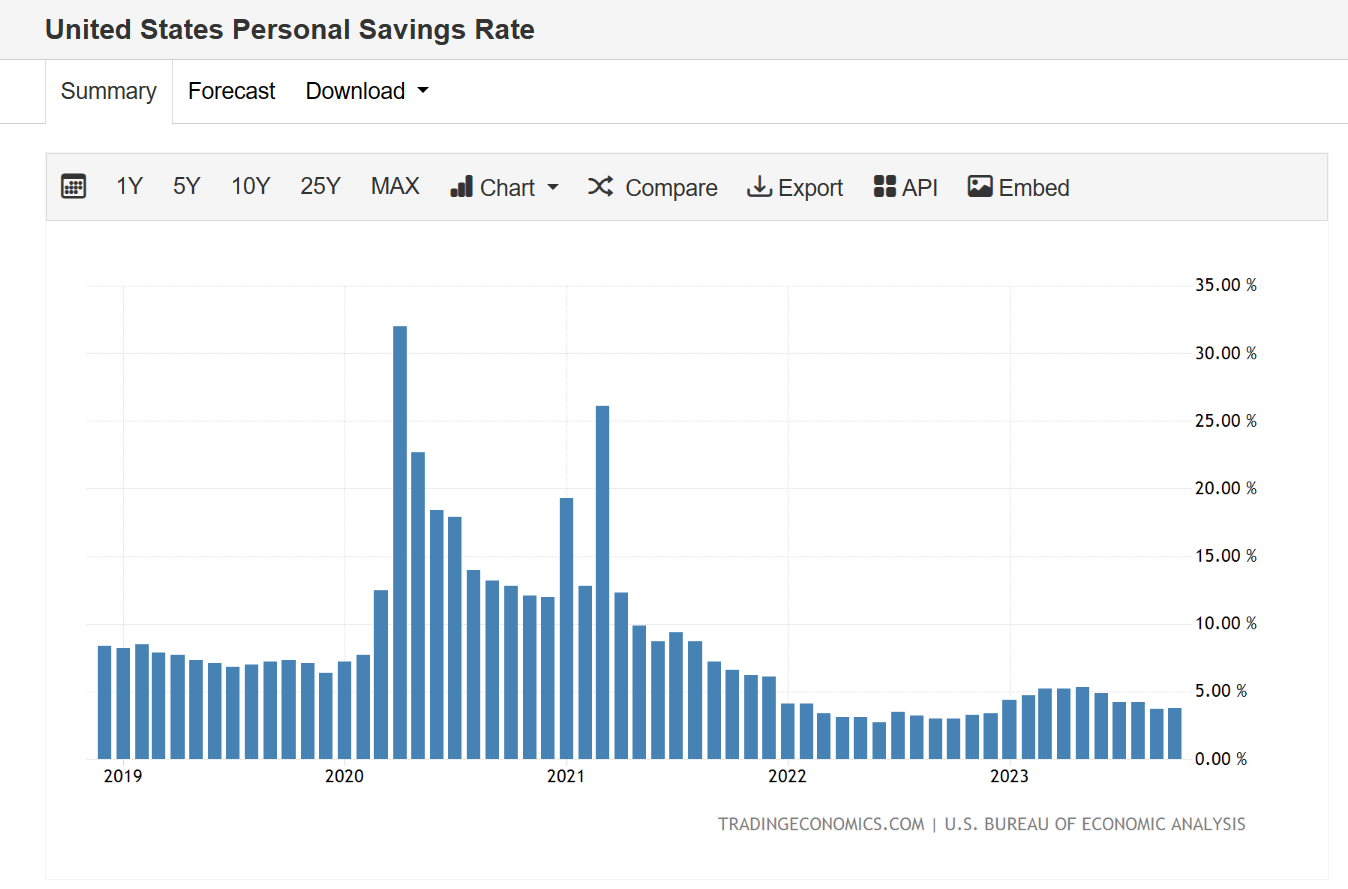

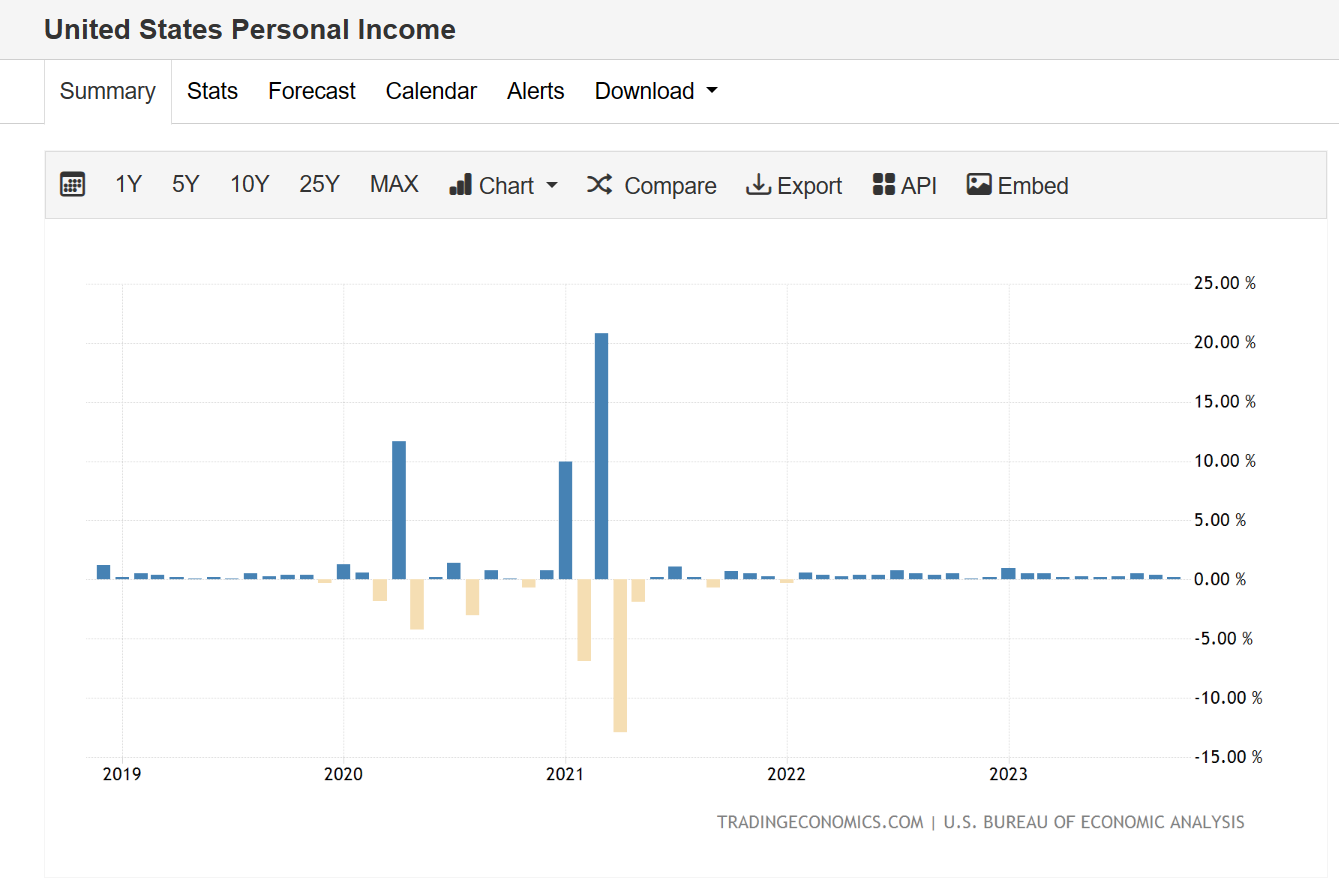

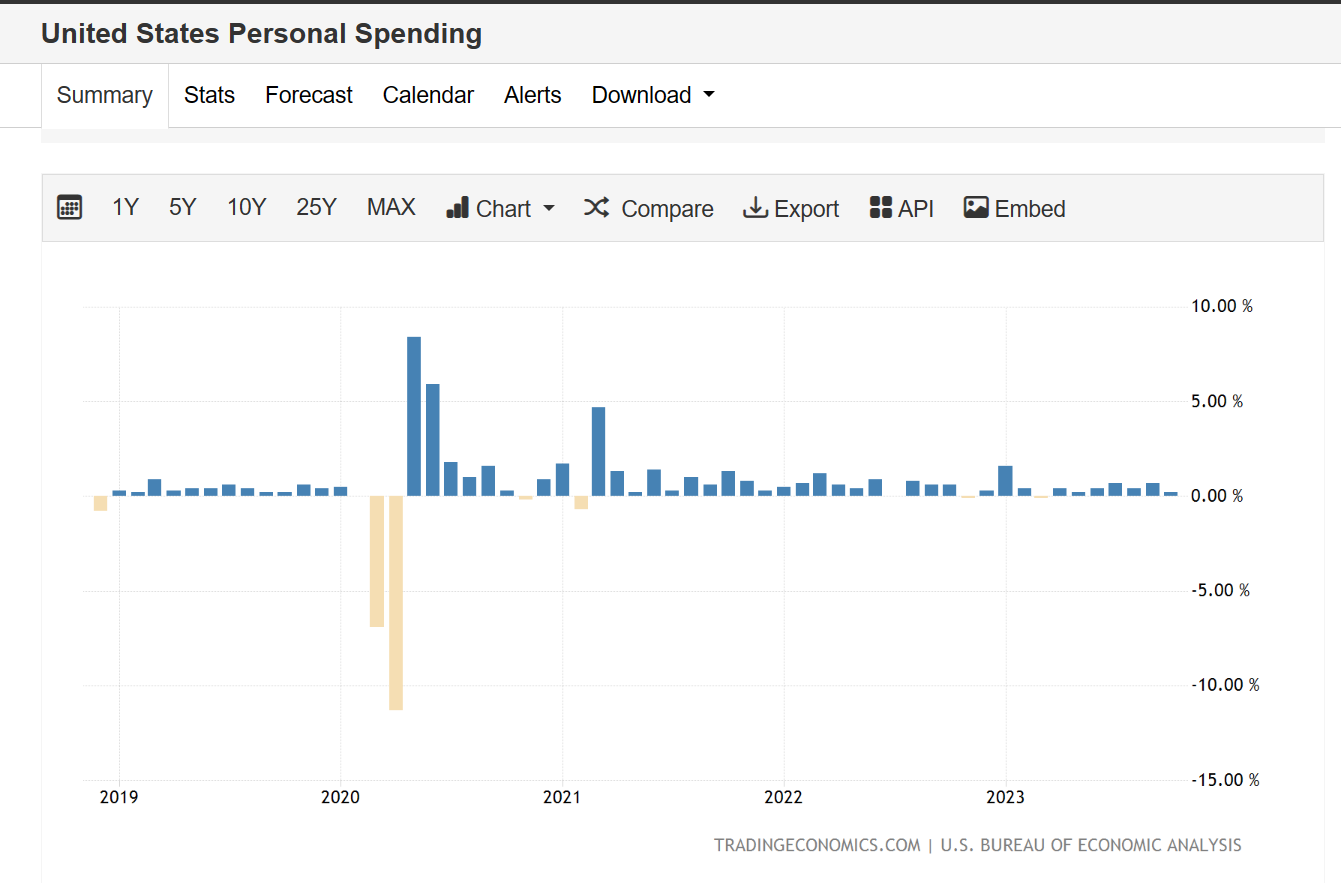

I am going to pay close attention to consumer data. Although consumer spending has been strong, a slowdown in consumer spending can translate into worse than expected economic data over time. In the slideshow below you can first see the strength of consumer spending, but as you scroll you can see some weakening data points.

Escalating Middle East Scenario:

The war happening in Gaza is terrible and heartbreaking. We pray that there can be peace. With such an unfortunate set of events, there has been no end to the horrible situation. An escalation in the war can mean big implications for supply chains, certain commodities, and global markets. We pray for a ceasefire, and we pray for all the families affected by the war.

US Economy Gets Worst:

The Fed manufactured a slowdown during this latest rate hiking cycle. Although it is unlikely, it is not impossible that economic data continues to slow down further than the Fed would like. If economic data continues to degrade past current Fed targets, that could mean issues for the stock market. Once again, I am not predicting this scenario, but you do not want to get caught off guard if this happens to be the outcome.

When it comes to risk, I believe you should always have a plan for how you think the market will perform, but you should always be prepared for adverse scenarios. Investors who are prepared can move swiftly in adversity and protect or even generate returns for their portfolios.

Key Themes

Going into 2024, I will be focusing on the following themes. I will be writing more extensive article on these topics:

Japanese Yen

Japanese Yen is at all-time lows, and the Bank of Japan may be forced to raise interest rates to strengthen their currency. This will be the beginning of a rate raising cycle, something Japan has not seen in a while.

Oil

Saudi Arabia and other OPEC countries are looking to maintain $100/barrel oil. There is a battle going on between what OPEC leaders want and what the US wants, which is oil cheaper than $100 but not too cheap either. High oil means high inflation.

Commodities (Renewable energy, technology & clean tech related)

We want to investigate supply and demand factors for commodities and see if there are any opportunities.

Electrical Grid

There are a few things happening in this space. One major headline right now is Russia potentially cutting off Uranium to the US. Russian Uranium is responsible for powering roughly 20% of US electricity. There is also the growing demand for electricity usage from data centers and other technology-related uses. I am looking to investigate supply and demand dynamics of the electrical grid.

Uranium

Two major drivers in Uranium. First, countries globally are looking to nuclear power as an alternative to fossil fuels. There is currently a boom in building nuclear reactors around the world. Second, Russia threatening to not sell to the US can send prices soaring.

US Interest Rates

Interest rate decisions will have major effects on the market. This is something we are watching very closely.

Technology Infrastructure

I am still very bullish on technology infrastructure. Technology demand is still growing and in developing countries technology adoption is growing.

Quantum Computing

This is the breakthrough no one is talking about. We may be sometime away, but I am looking to invest long term in quantum computing companies.

Solar

With interest rates potentially coming down, I expect a lift in Solar stocks.

US Infrastructure

Biden signed a trillion-dollar spending bill that will be funding infrastructure projects in the US, I expect the boom in this space to continue.

Mexico

Mexico is benefiting from nearshoring and the US moving its manufacturing away from China’s and its allies to countries like Mexico. Mexico has seen robust growth, and we expect that trend to continue.

Saudi Arabia

Saudi Arabia is making a lot of investments in real estate, technology, media, and entertainment to diversify its self-outside of oil. They are also seeking $100 oil which would lift their GDP.

China

China has been facing economic challenges since their zero COVID lockdown policy. Even with multiple rounds of stimulus, China is still reporting sluggish economic data. I will be paying close attention to China and the outcomes of its policy decisions.

Geopolitical Tensions

Geopolitical tensions are still high, I am paying close attention, so I am prepared if anything were to happen. The world is changing and there is a real fight for both military and economic dominance globally.

This is what I will be looking at going into 2024, feel free to leave a comment with your thoughts or questions!