Japanese Yen Trade Idea

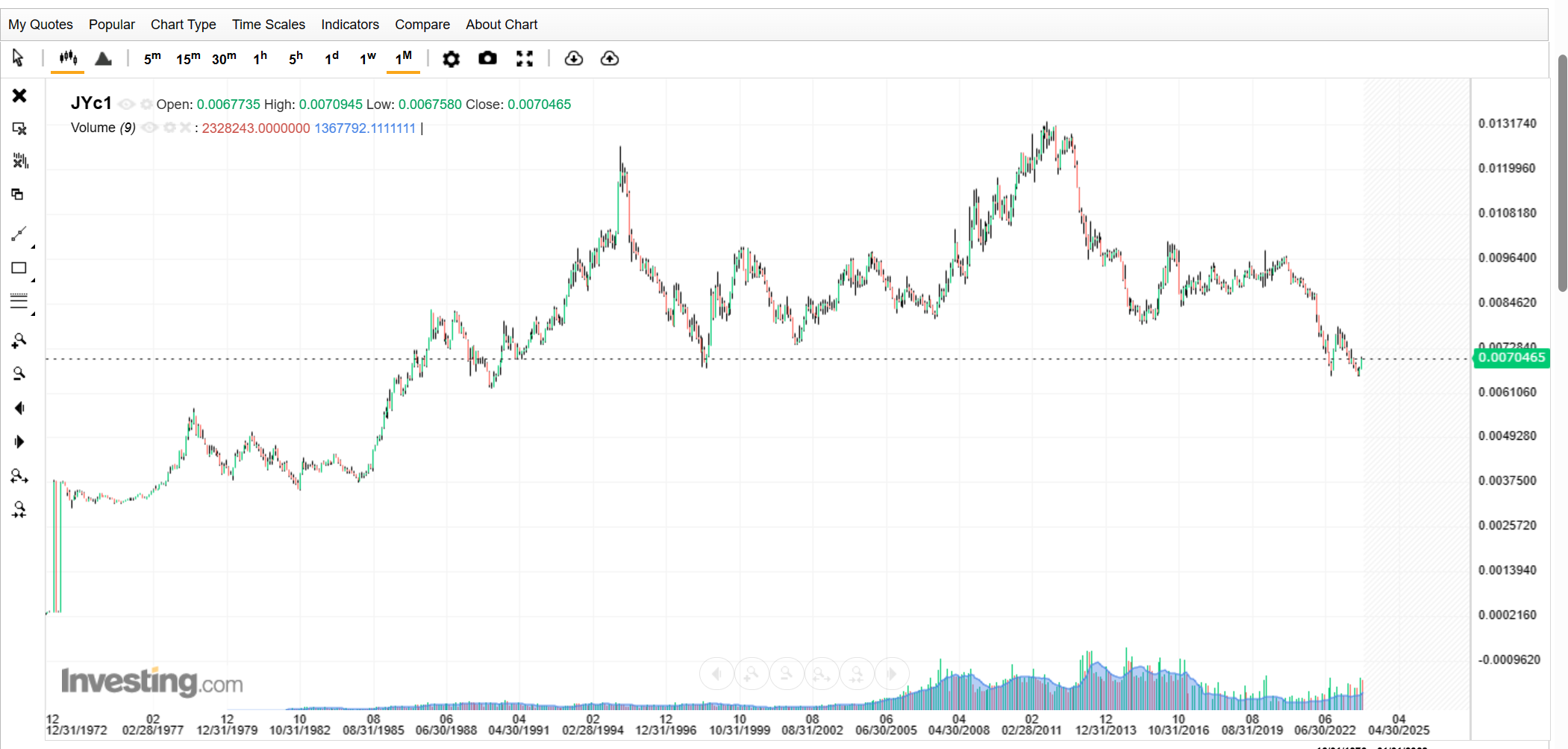

The recent plunge in the Japanese Yen, has bought the currency to levels we haven’t seen since 1990! The recent plunge may force the Bank of Japan (Japan’s central bank) to raise interest rates. This scenario will create a low risk – high reward trading opportunity in the Yen and Japanese Bonds. The chart below is a 50-year chart on Japanese Yen Futures.

This has been a trade I’ve been waiting for patiently since July 2022 and the moment is finally here! We’ve been actively discussing it in our private group chat.

Thesis

The currency freefalling the way it has, is beginning to create problems for Japan’s economy, so the Bank of Japan may raise interest rates. The beginning of a rate raising cycle, depending on how fast and how high Japan raises rates, could mean a low risk - high reward opportunity to go long on the Yen. This would be explosive because of Japan’s nearly 30-year low interest rate policy.

Background

When a central bank raises interest rates, historically the currency rises, and bond prices fall. When a cental bank lowers rates, the opposite happens. Japan has been maintaining negative interest rates since 2016 and has been at or near zero since 2000. If the Bank of Japan enters a rate raising cycle, this could be the beginning of a bull run in the Yen that we haven’t seen in years. Couple that with US central bank beginning their rate lowering cycle, this could be an added boost to the Japanese Yen.

As a rule, I do not make predictions, I am reactionary. If the Bank of Japan never raises rates, I won’t make this trade. The central bank would need to officially raise rates, or I see conditions that will force the central bank to make that decision for me to officially enter the trade.

Trade Setup

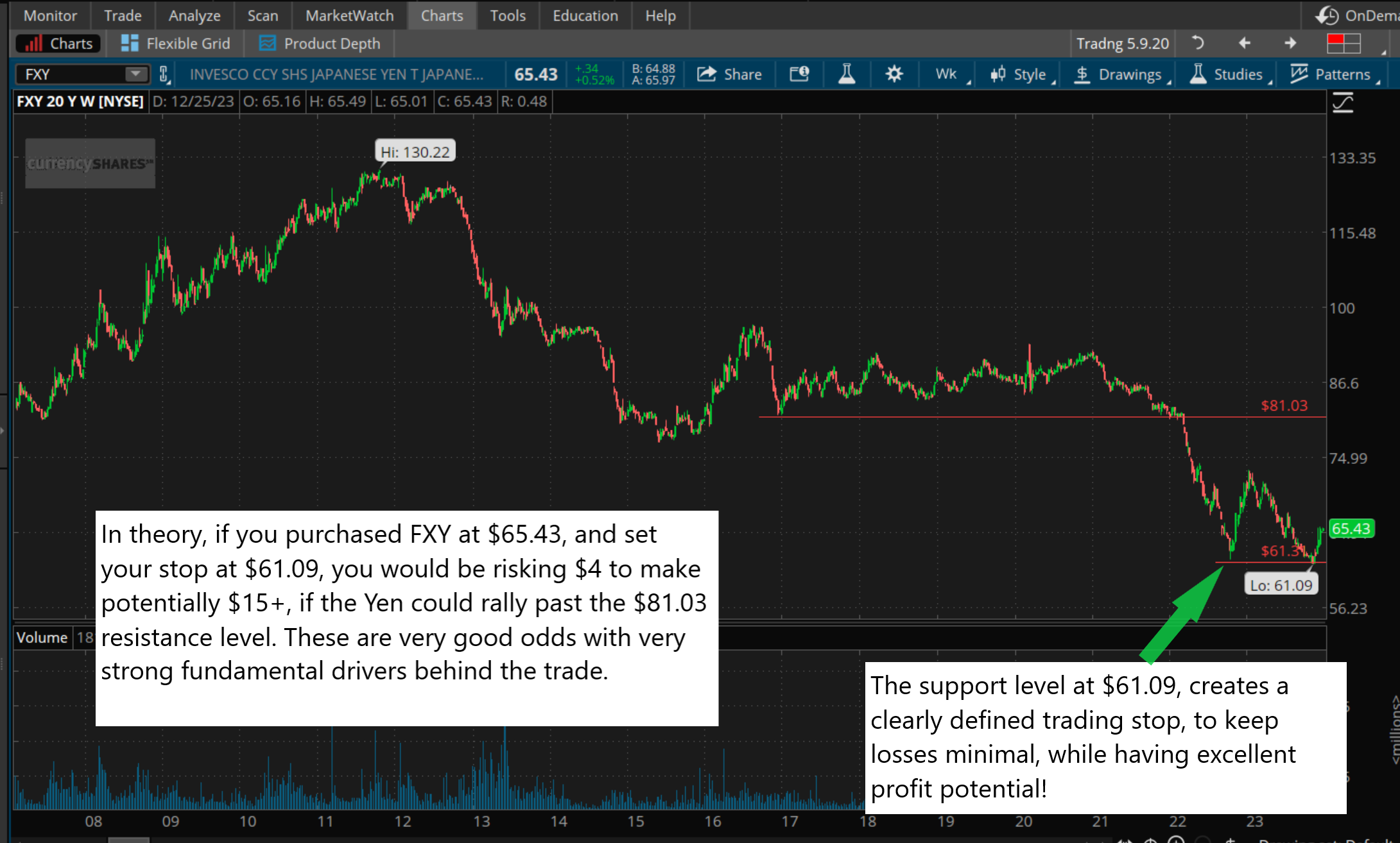

This trade is setting up to be a reversal trade. The goal is to buy the lows and ride the momentum driven by rising interest rates into the highs. Once that theme is completed or reversing course, we will exit our position.

Technical analysis

Below are long term monthly charts on Japanese Yen to give you a clear picture of the way the Japanese Yen has been trending and to give you a feel for where the Yen is trading at a macro level.

Below is a chart on FXY, a Japanese Yen ETF. I will be using FXY to express this trade idea buying both shares and options. In the charts below I breakdown the trade setup.

PREPARATION IS KEY: Notice how I’m fully prepared with my trade idea. The moment relevant breaking news comes out, I can quickly execute my trade. Preparation is key to trading success.

Economic Data

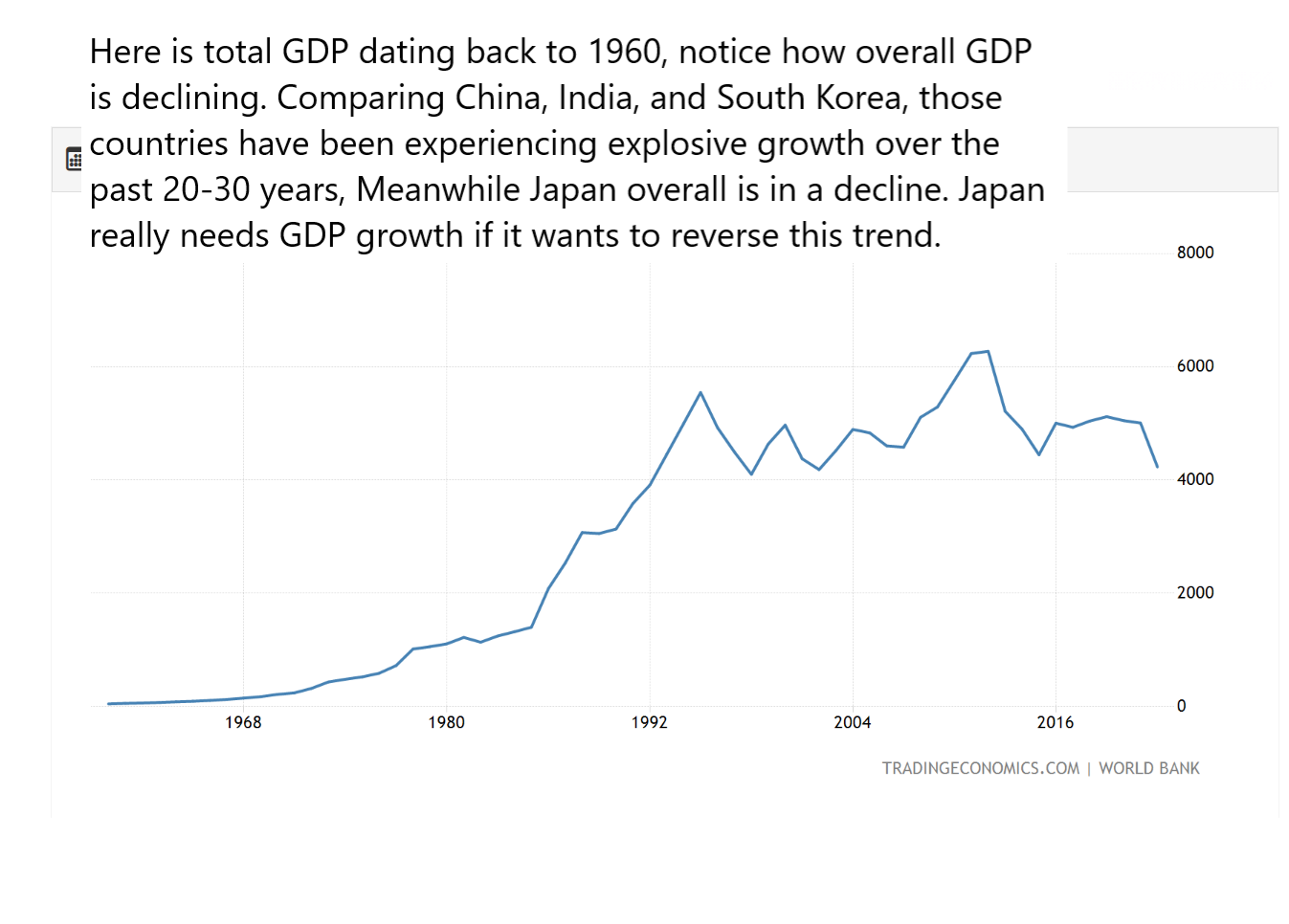

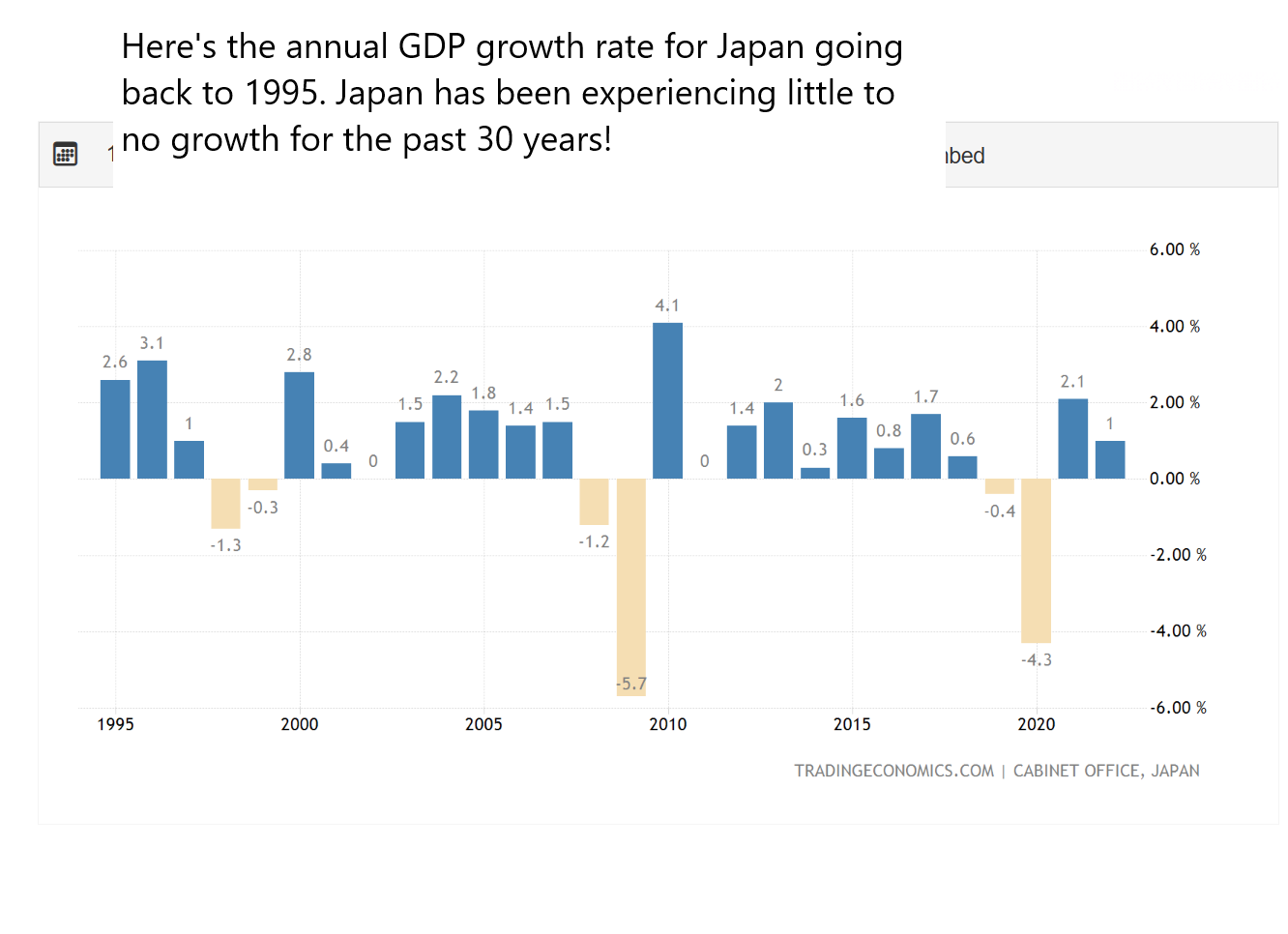

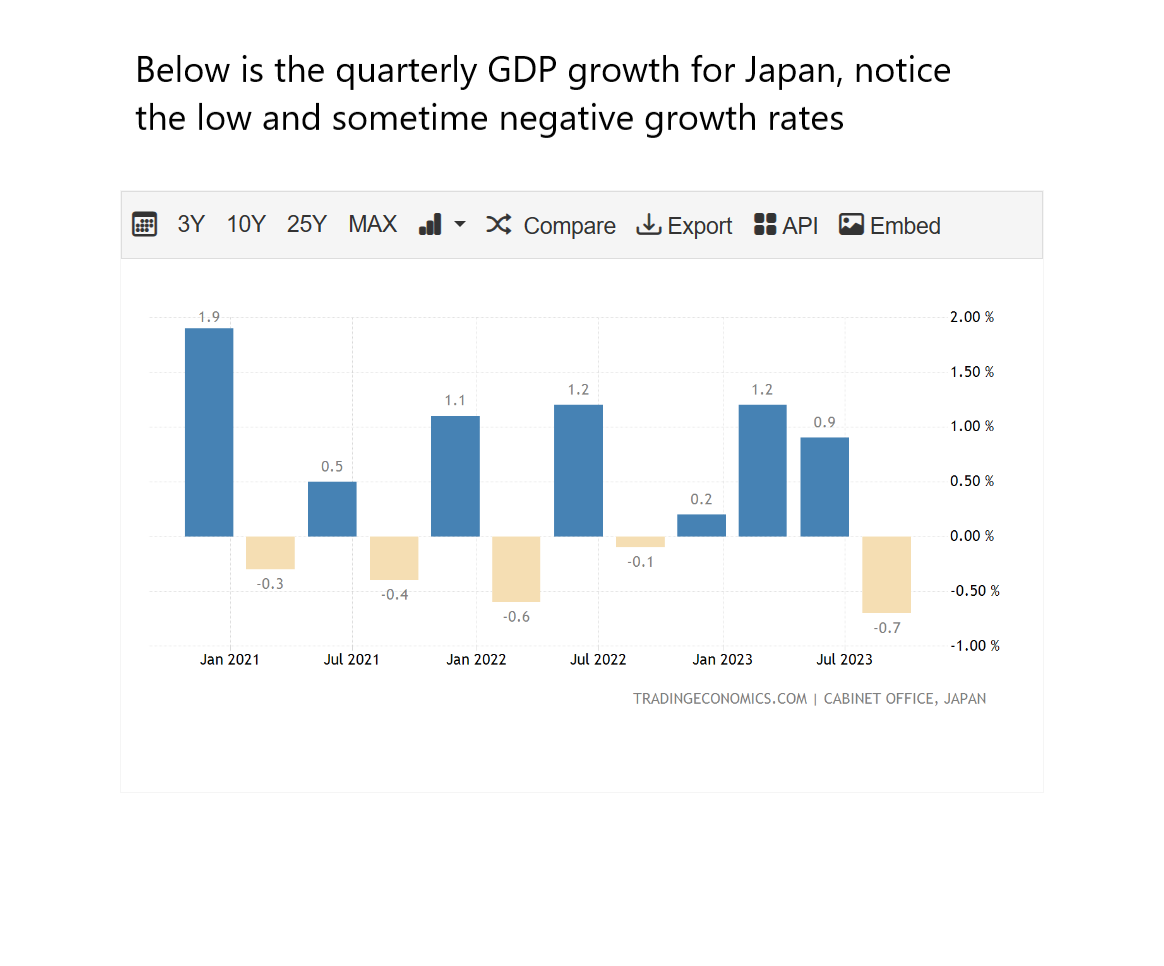

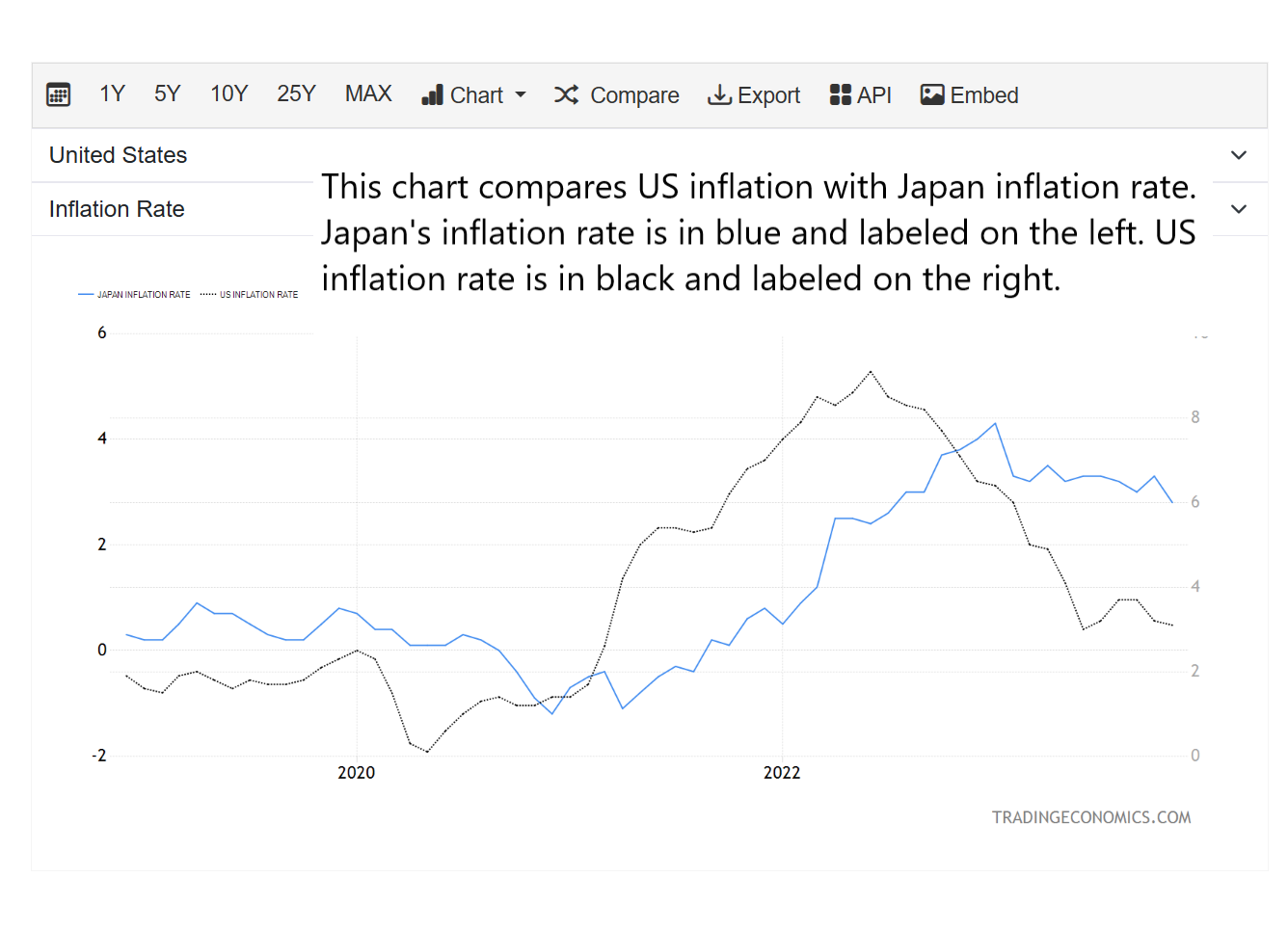

The weakening Japanese Yen is making everything more expensive for people who live in Japan. Japan has been experiencing very low growth. Japan would like to see economic growth and maintain a 2% inflation target before raising rates. Raising rate prematurely will slow down Japanese growth prematurely which would be a lose-lose situation for the economy. As stated earlier in the slides, the US will potentially cut rates in 2024. The US cutting rates will give the Yen a boost without Japan raising rates.

Below are some charts on inflation and GDP growth for Japan.

The situation with the Japanese Yen is setting us up for an easy trading opportunity. Of course nothing here is a recommendation for anyone to make an investment decision. We are just sharing our process and what we are looking to execute for our personal investment portoflios. Please work with your financial advisor to make sure you find the right opportutnies that are in line with your goals. Please leave a comment if you have any questions or thoughts. We will be publishing a formal research report on the state of Japan’s economy. Subscribe to our blog to stay up to date with the latest research and journal entries!