Japanese Yen Trade Update

We recently authored an article about the opportunity in the Japanese Yen due to Japan’s Central Bank, The Bank of Japan (BoJ), raising interest rates. As a reminder, currencies have a positive correlation with interest rates. When rates go up, currencies go up, when rates go down currencies go down.

Coming into the new year, Japan saw easing inflation and good economic data. BoJ leaders began communicating potentially raising interest rates, which lead to a rally in the Japanese Yen.

There are 3 major factors that may drive the Yen lower, 2 of which may keep the BoJ from raising rates. The 3 factors affecting the Japanese Yen are

Weakening Japanese Economy

Rising Global Inflation

Higher for longer US interest rates

Weakening Japanese Economy

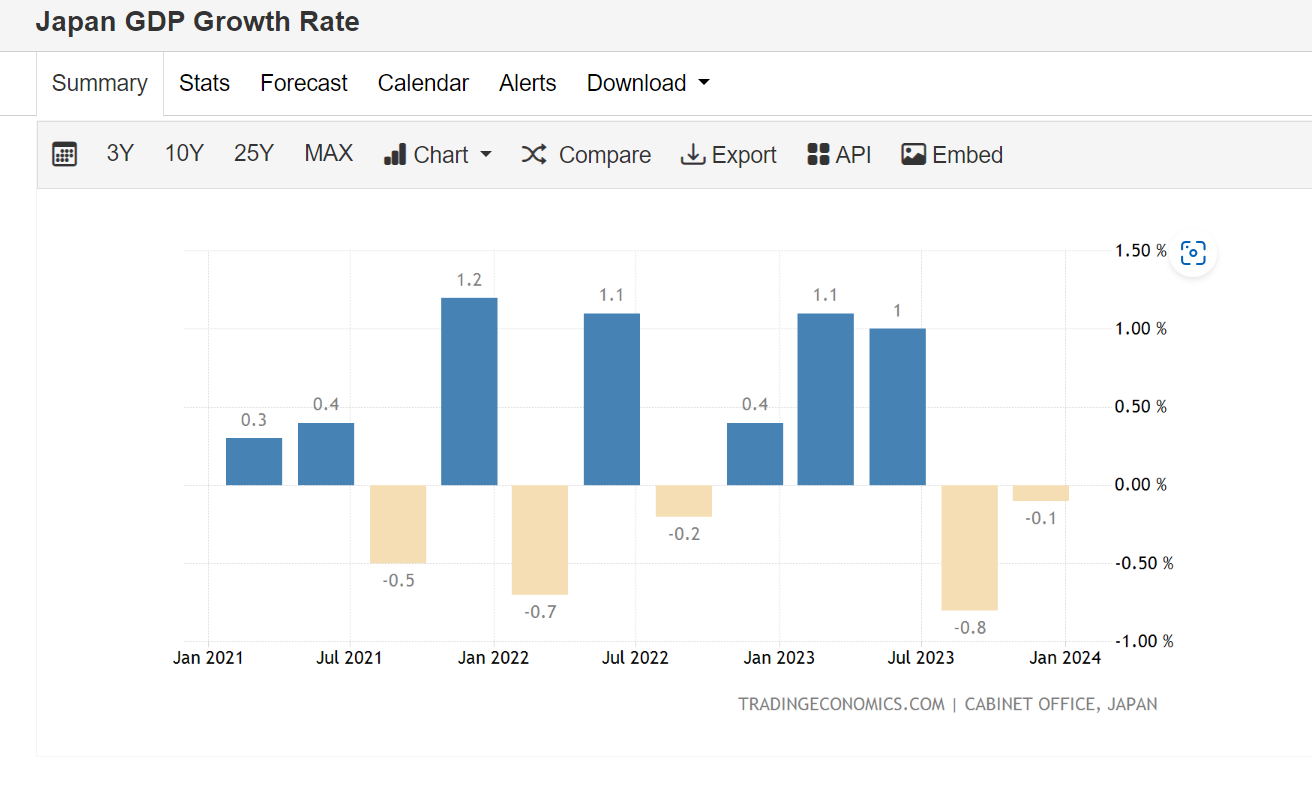

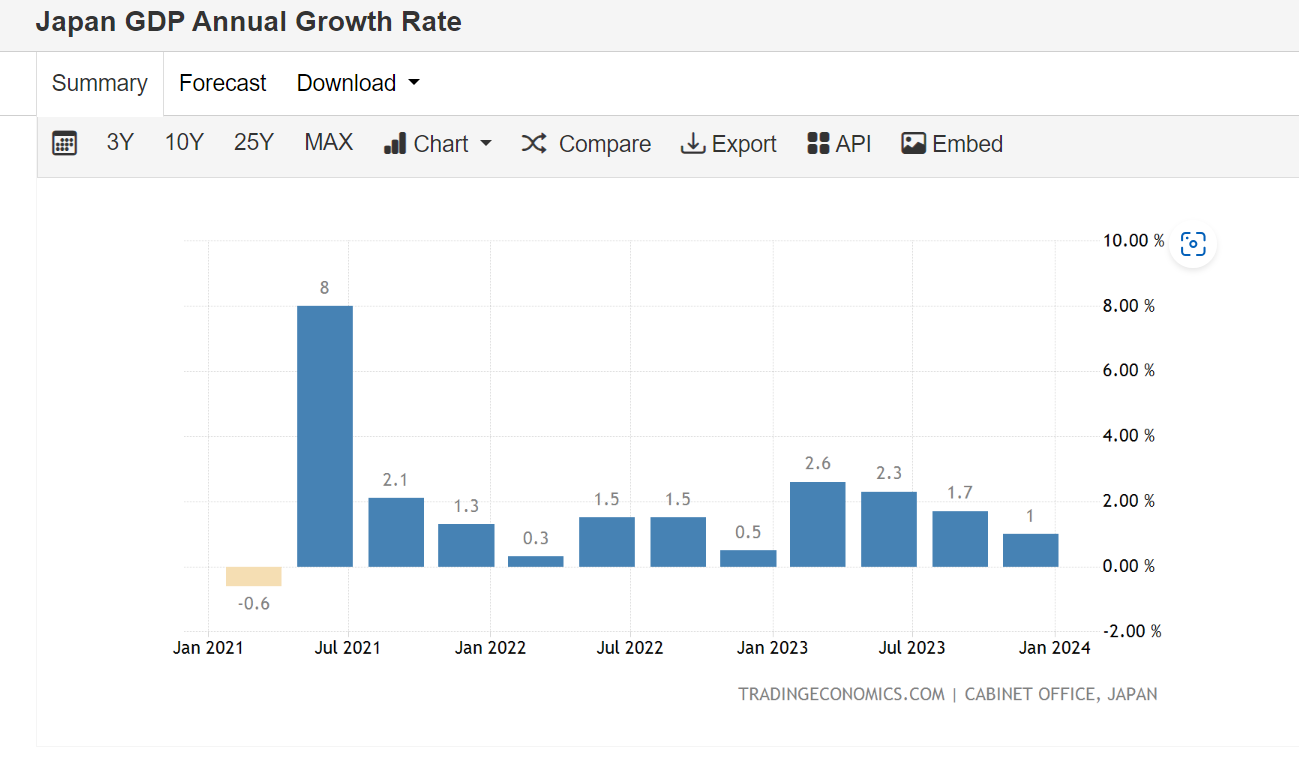

Recently, Japan reported weaker than expected growth for their preliminary GDP report. These results may make it tough for the Bank of Japan to raise rates, especially if economic data continues to come in weak. Japan has technically entered a recession with back to back negative GDP growth. If the BoJ raises rates during a recession it may worsen the current economic situation.

The first slide is Japan’s quarterly GDP growth, the second slide is year over year.

Rising Global Inflation

A key data point for the BoJ has been inflation. As stated in our 2024 investment outlook, there are still challenges for inflation. The escalating war in the Middle East is affecting supply chains, which in turn affects global inflation. With the US entering the war, and approving aid to Israel, it seems the war will continue and will potentially further impact supply chains and drive global inflation higher. Additionally, the US reported an uptick in inflation in its latest inflation report.

Higher for Longer US Interest Rates.

With the US Dollar and Japanese Yen being one of the major currency pairs globally, economic developments and interest rate decisions in the US effects the Japanese Yen. In short, higher for longer rates means a stronger Dollar, and a stronger Dollar means a weaker Yen. With economic data still coming in strong for the US and a recent uptick in US inflation, the Fed may postpone raising US interest rates.

Consumer Price Index Summary - 2024 M01 Results (bls.gov) (Official US Inflation Press Release)

Looking Ahead

The Bank of Japan has a slew of economic data set to be released over the next few weeks including interest rates. These data points will help us anticipate the next decision by the BoJ.

Also, on 2/21/24 several Fed officials will be speaking, and Fed minutes are set to be released. At the end of March, the Fed will announce its interest rate decision. If the US consumer remains strong and global inflation picks up, I expect the Fed to wait on cutting rates.

Important Dates

3/20 - 2:00PM EST –US Interest Rates Announcement

3/18 - Tentative – Japan Monetary Policy

3/18 - Tentative – Japan Interest Rates Announcement

Conclusion

I am currently short the Japanese Yen, I am betting that Japan will not raise rates and that the US will not cut rates at their next respective interest rate meetings. I will pay attention to economic developments and statements from central bank leaders as the dates for interest rate decisions near. In the screenshots below you can see where I entered the Japanese Yen, and where my stop is set if I’m wrong on the trade. Although I’m still bullish on the Yen once Japan raises rates, I saw an easy short term trading opportunity to capitalize on.