US Dollar Trade Review

The US Dollar short has been a trade I’ve been eyeing for a very long time. This trade is simple, there’s a direct correlation between interest rates and the US Dollar. When interest rates go up, the US Dollar goes up, when interest rates go down the US Dollar goes down.

To short the USD, I didn’t do a forex trade, I bought puts on UUP, a US Dollar ETF.

At the beginning of the year in March I tried to short the USD in hopes of the rate lowering cycle beginning but I was early to the party and was stopped out of my position.

Trading Mistakes :

Didn’t cut losses

Tried to sit through volatility

Didn’t exit at set stops

Trade Setup

Recently I seen the Dollar climbing while seeing consistently weakening economic data, I took this as an opportunity to short. Here’s a screenshot of my entries and exits for this trade. Use this as a reference for the rest of the article.

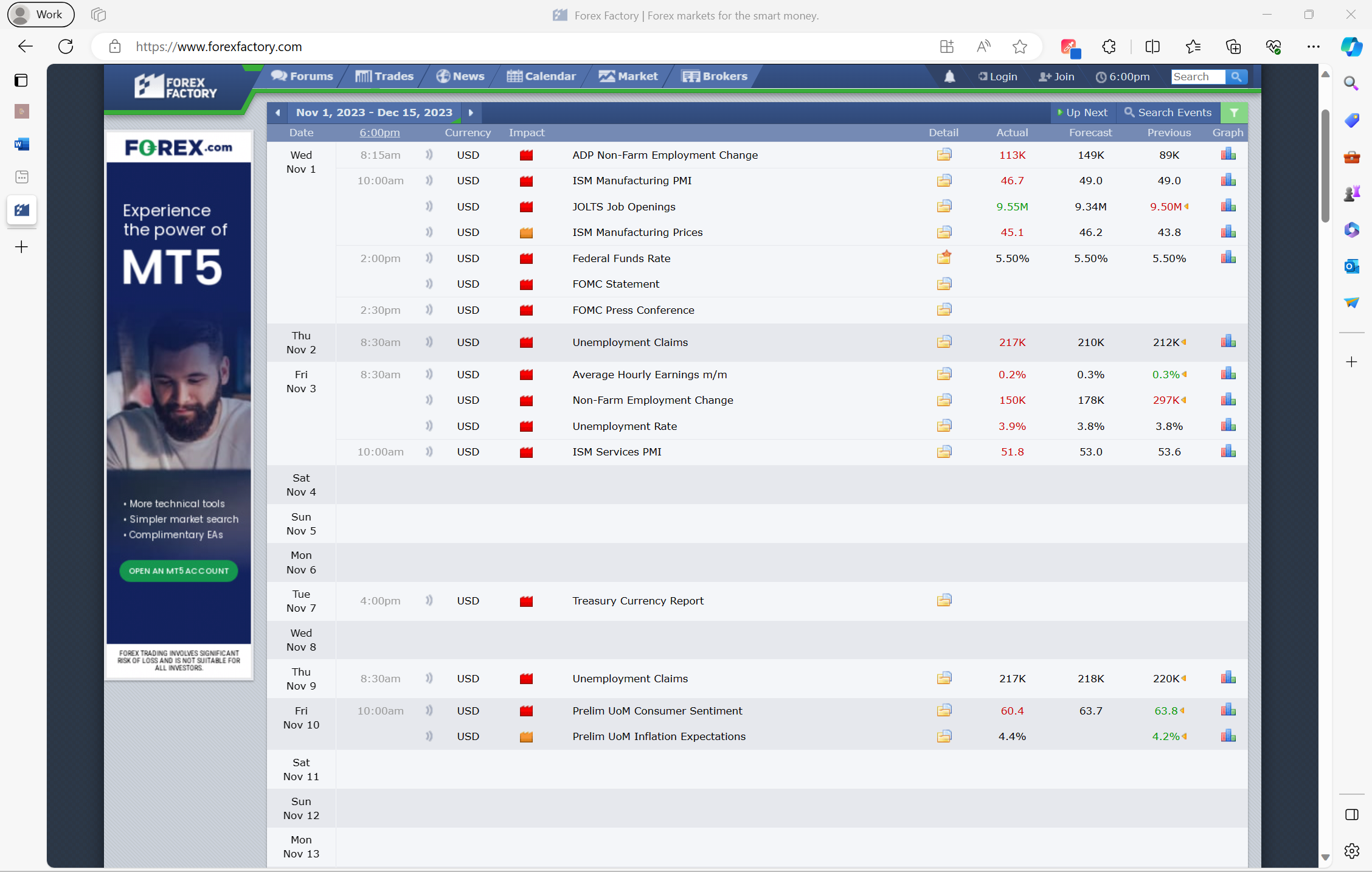

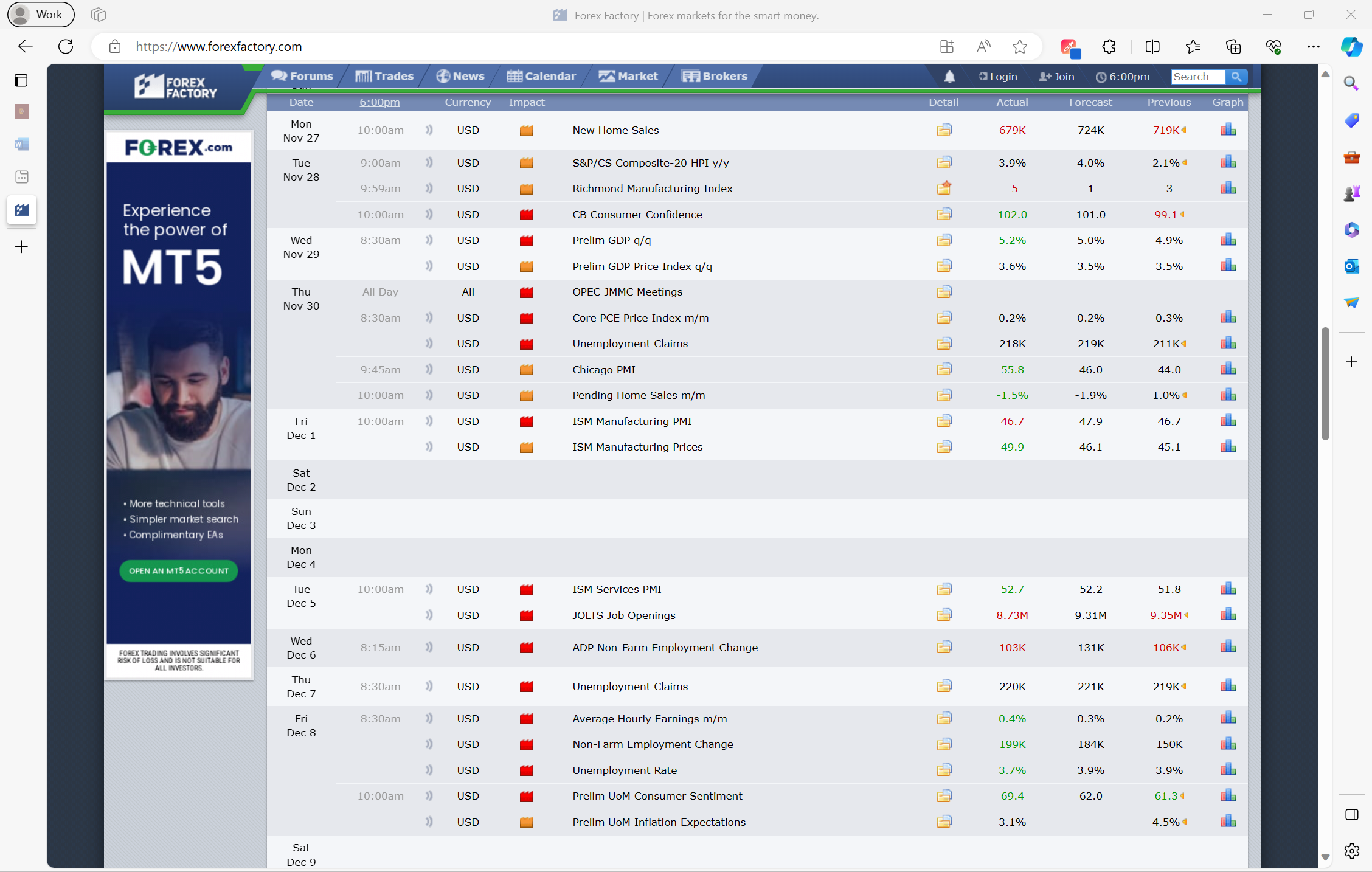

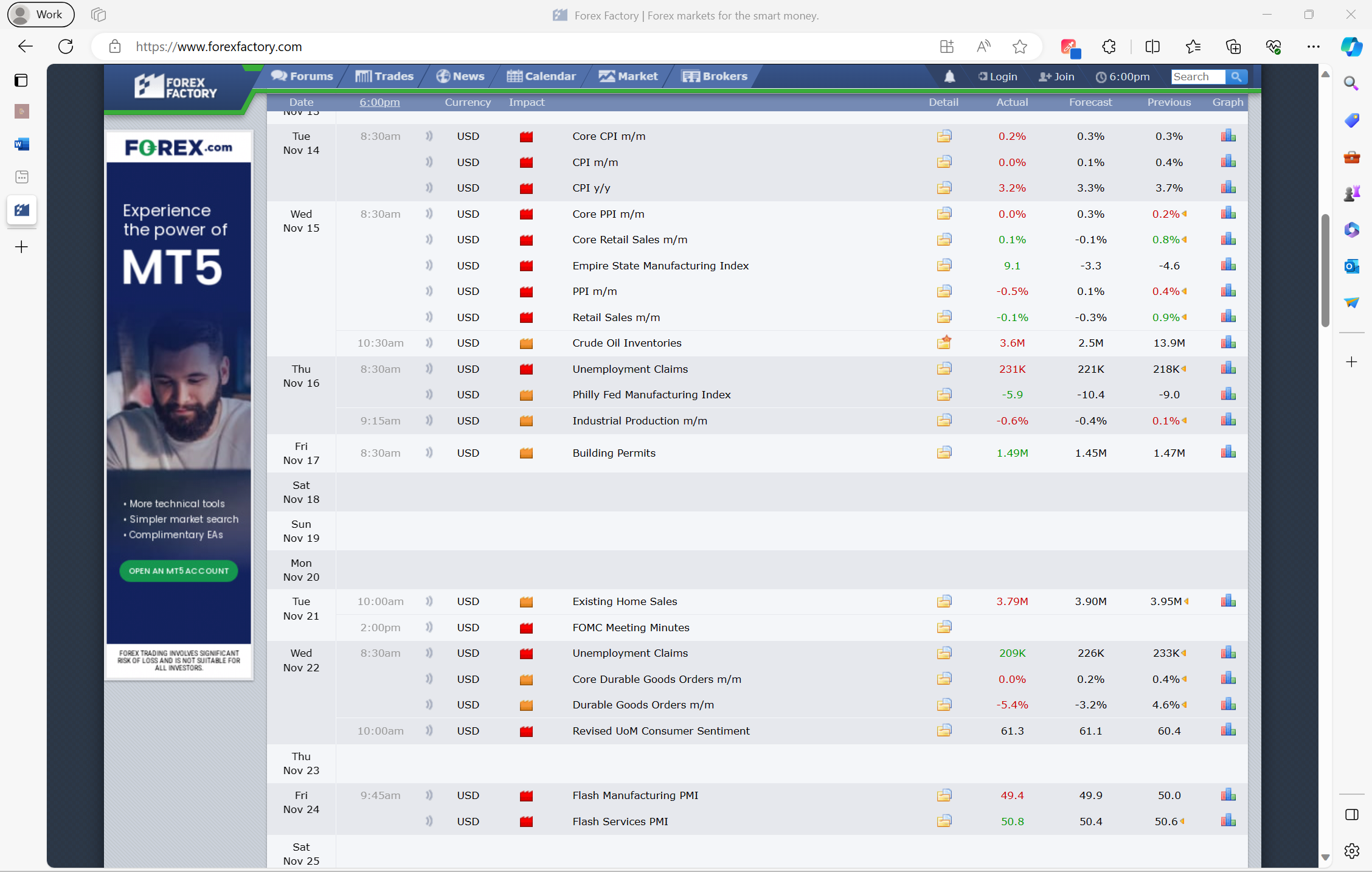

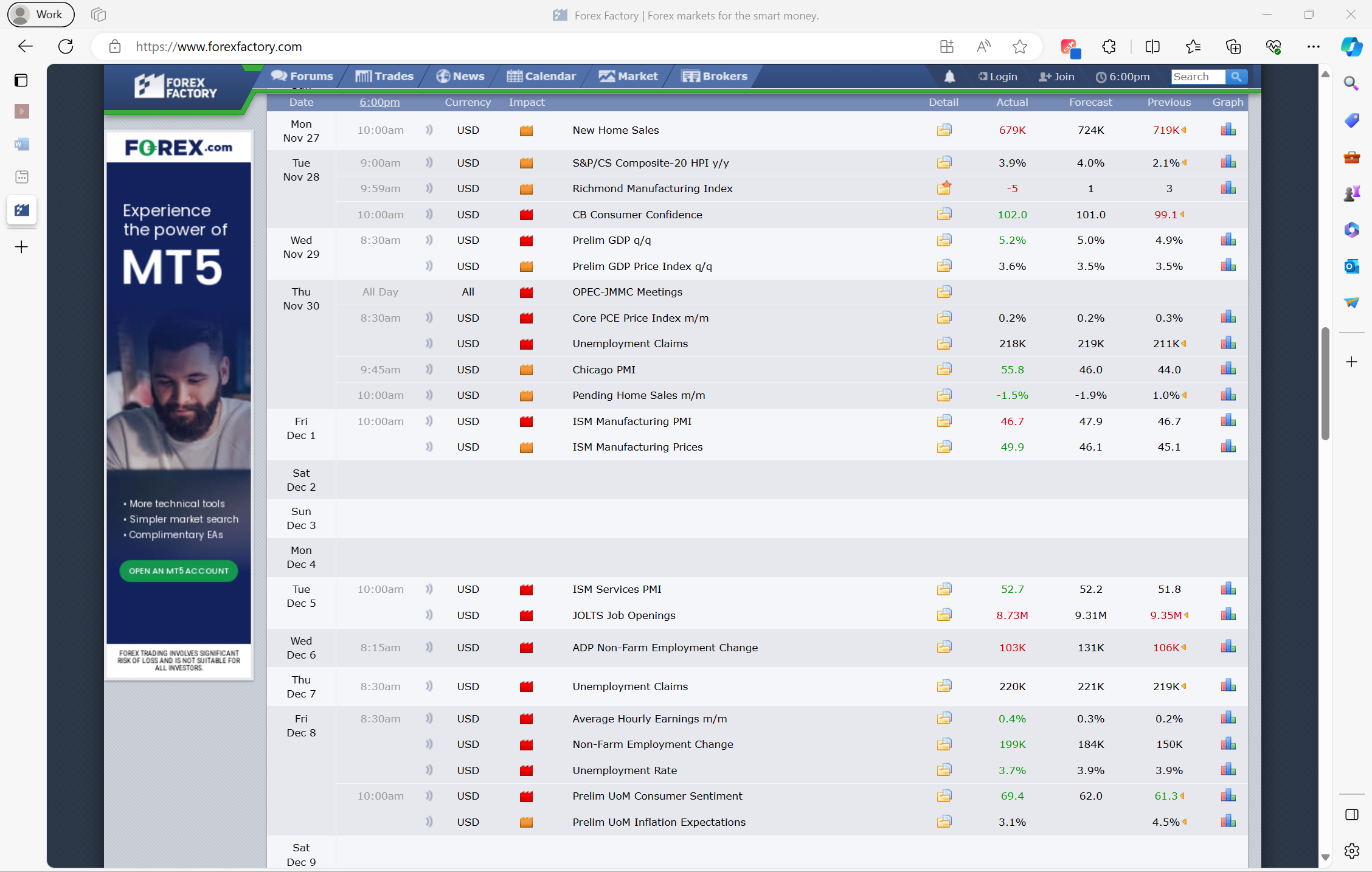

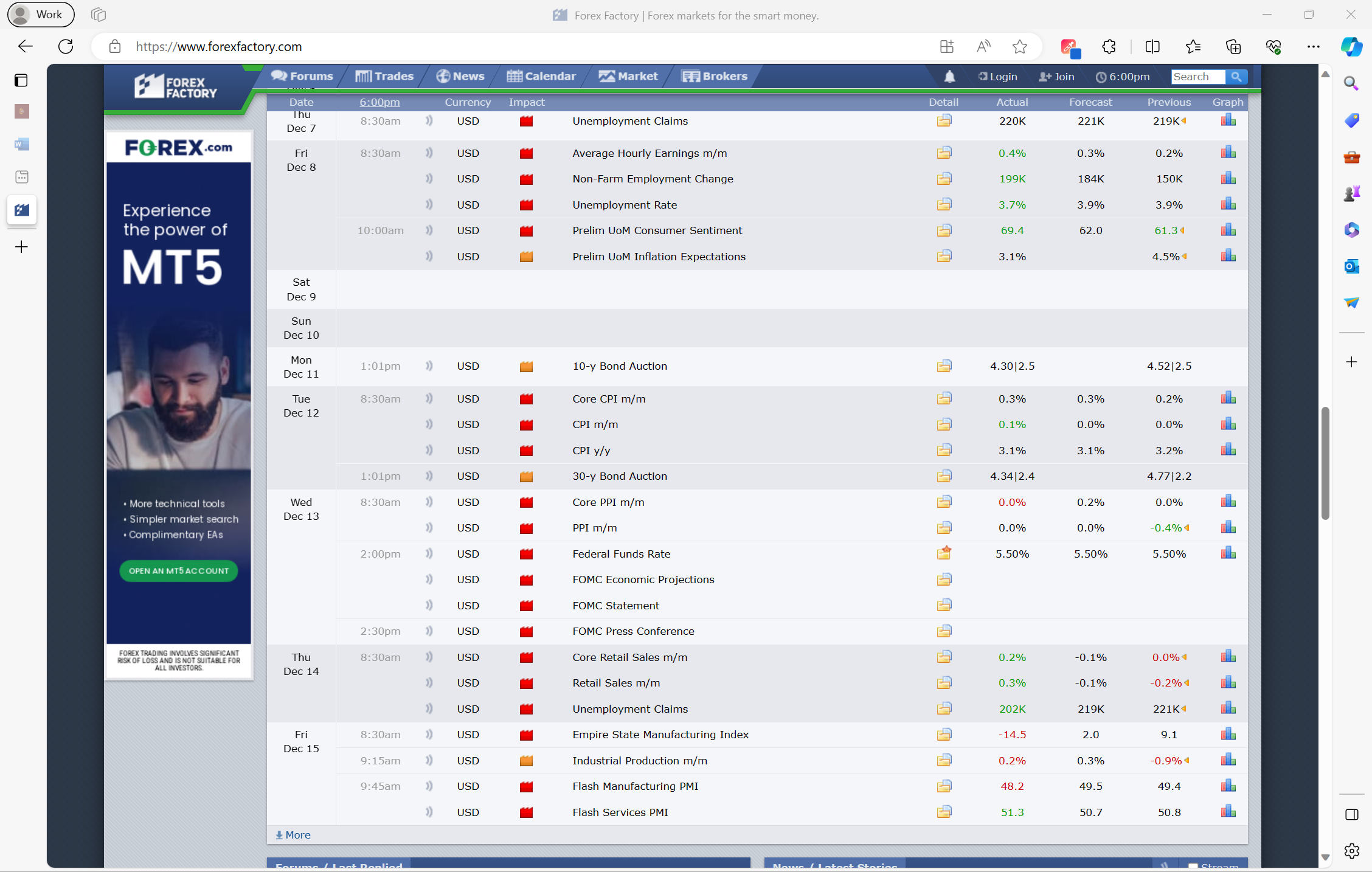

Please reference the screenshots below to see economic data next to a chart

In the screenshots below, you can see the dates of economic data from Nov 1 – Dec 9. The screenshot is a chart on UUP from Nov 1 - Nov 29. Notice how weak economic data is coming in and the US Dollar is trending lower.

When I initiated my trade, I felt we would see follow through on the US Dollar moving lower. Look at this next set of economic data from Nov 27 – Dec 15 as well as the chart on UUP from Nov 20 – Dec 15. Notice how UUP was trending higher on the latest set of economic data which came in a bit mixed. Overall, I felt key data points came in weaker but there were a few positive data points.

I felt with weak economic data coming in, the USD would start trending lower immediately during that period. Instead, the USD rallied, I added on the rally. I accidentally bought the wrong options and had to quickly sell taking a small loss but a loss, nonetheless. I doubled my position size, going into the next round of economic data which I was expecting to be weak because the first round of economic data was weak. The economic data came in weak but still the dollar was holding up, my options were losing, I ended up selling half of the position at a 50% loss. I figured I would ride the rest into the Fed announcement.

Risk Management Issues

I made a few mistakes, I almost never find myself in this position willing to gamble for zero on a trade, but this was my best option from a risk reward standpoint. The loss I would be taking, I could easily make double or triple on a winning options trade, but if we had a favorable Fed announcement based on the economic data coming in, I could maybe break even or have a much smaller loss instead of losing 70%+ on the trade. The mistakes I made were as follows:

I bought options contracts with a 2-week expiration date.

I normally buy options contracts with an expiration of 90 days or more so I can sit through more volatility and catch a larger move in a trade. Shorter-term contracts, especially 2 weeks, have immense volatility. I was greedy when I first made the trade. I was looking to make a quick buck, not catch the larger trend trade in USD if the rate lowering cycle was to begin.

I didn't do my homework.

Before I put on a trade, I normally search for key dates related to economic data, speeches, announcements, reports, etc. In this trade I did none of that. I was only paying attention to immediate economic data releases. I was lucky that my expiration date happened to be on 12/15 two days after the Fed meeting on interest rates. I wasn’t even aware the rates meeting was coming up so soon. This goes back to being greedy. I was only focused on making a quick buck, not making the right trade. These mistakes are inexcusable.

I was in such a bad situation for those 2 reasons. I really stepped out of my discipline as a trader, something I seldom do these days.

Here Comes the Fed Announcement

The Fed announcement came, and they announce they will lower interest rates 3 times at a rate of .25% each. When I heard that I figured let me ride the Dollar into the close and on the close the US Dollar tanked! Finally got the drop and had a huge gain. When I saw that I figured I ride it into the next day. There was another really big drop on the US Dollar, and I was able to sell my puts at the lows of the day. Capturing a gain of 667% for the day and 108% on the position! What a swing 2 days before the fed announcement my position was as low as –91% and it swung all the way to +108%. For me this was an unbelievable turn of events and showed me the power of short-term expiration dates. I have a strategy for how I will use short term expiration dates, but that will be for special situations. Strictly for when there is a mispricing going into a major report or announcement like what we saw here with the US Dollar. I was originally going to share this trade idea as a lesson on how you can be right about a thesis, but poor execution can lead to losses, I ended up getting lucky and making out with a profit on the last set of options. I maybe broke even on the options trade overall.